In the world of retrospective invoicing, there is an unusual and accepted imbalance of power, liability and payment risk. It’s a scenario where those who provide goods or services often find themselves not just fulfilling their obligations but also acting as a de facto banking institution for their customers. Yes, we’re talking about the plight of contractors, suppliers, and anyone who invoices for payment. They complete the work, deliver the goods, and then… wait. And wait some more. All the while, they have their own bills to pay, employees to remunerate and their own suppliers demands. The question arises: Why should the burden of cash flow management fall on the shoulders of those who’ve already fulfilled their end of the bargain?

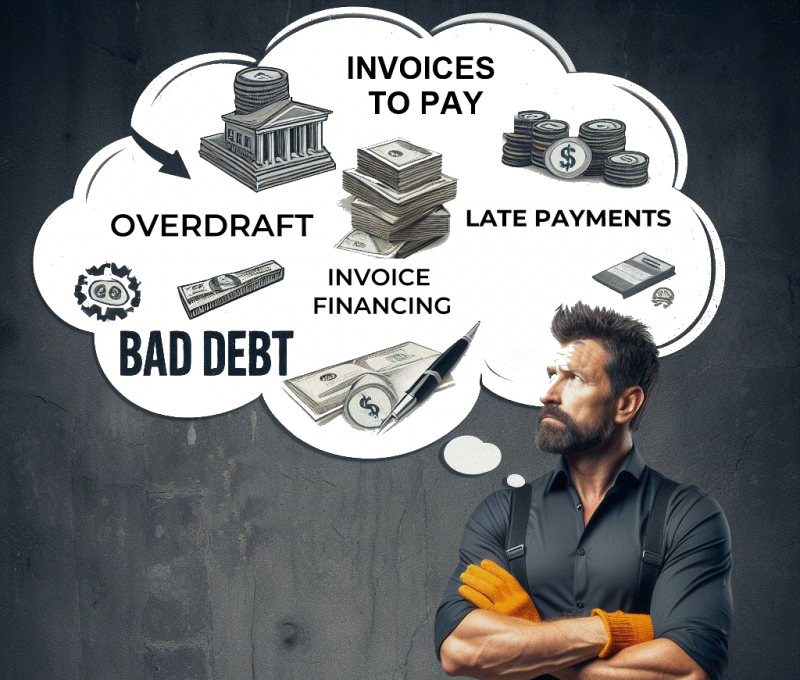

Picture this:

A contractor pours their sweat and expertise into a project, only to find themselves staring at a payment term that stretches out for weeks, or even months. Meanwhile, they need to cover the costs of materials, labour, and overhead (i.e. insurances, rent and utilities). How do they manage? Often, they turn to financial instruments like overdraft facilities, invoice financing, or factoring. These tools provide short-term relief by allowing them to access the funds tied up in the many unpaid invoices. All this comes at an actual cost in the form of interest which can range from 8 to over 20%. But let’s pause and consider the underlying issue here. Why should suppliers have to resort to such measures just to bridge the gap created by delayed payments?

Payment Risk:

What’s more concerning is that in some cases, suppliers are not only expected to wait for payment but are also pressured to arrange finance for their customers. It’s a situation where the payment risk is squarely placed on the supplier, while the customer enjoys the luxury of deferred payment without any consequences or often additional cost. This dynamic not only strains the financial health of suppliers but also creates an unfair power dynamic where the customer holds disproportionate leverage.

The Solution – IPromise:

But is there a better way? Enter IPromise, a solution that challenges this status quo. With IPromise, the paradigm shifts. Instead of suppliers extending credit and assuming payment risk, the money is collected upfront, held by IPromise in a BNZ Trust Account, placing the payment responsibility squarely on the customer requesting the service. This simple yet revolutionary concept not only alleviates the financial strain on suppliers but also fosters a more equitable and transparent transactional landscape. This is fair also in that the payment isn’t released until the supplier’s customer is satisfied that the job or agreed stage of the job is completed. It’s that simple!

Imagine a world where contractors and suppliers no longer have to juggle their cash flow to accommodate delayed payments or take a hit on their thin margins by arranging invoicing finance or factoring. A world where the risk is distributed fairly among all parties involved. That’s the promise of IPromise – a solution that not only addresses the symptoms but tackles the root cause of this systemic issue.

Remember, customers already pay unsecured amounts upfront for many services without realising the difference. Air travel, accommodation, concerts and or special event tickets are paid in some cases multiple months in advance. We never hesitate to hand over the money and yet it is less safe than IPromise where the money is released only when the agreed job is done.

Conclusion:

It’s high time we re-evaluate the dynamics of payment in invoice based transactions. The burden of cash flow management and risk of non-payment should not disproportionately fall on suppliers who have already fulfilled their part of the deal. By embracing innovative solutions like IPromise, we can create a more sustainable and equitable ecosystem where payment terms reflect the value exchanged, and the risk is fairly distributed.

Leave A Comment