Tradies

Engineers

Contractors

Consultants

Agencies

SMEs

Built and used everyday for businesses like

Tradies

Engineers

Contractors

Consultants

Agencies

SMEs

Secure Payments before you start the job

With IPromise you quote and secure payment before you even start! Your customer’s payment is held in a secure BNZ Trust Account (escrow account), and is paid to you as soon as the agreed job is done. What’s more, IPromise is always free for your customers.

How to make an IPromise Quote and send it

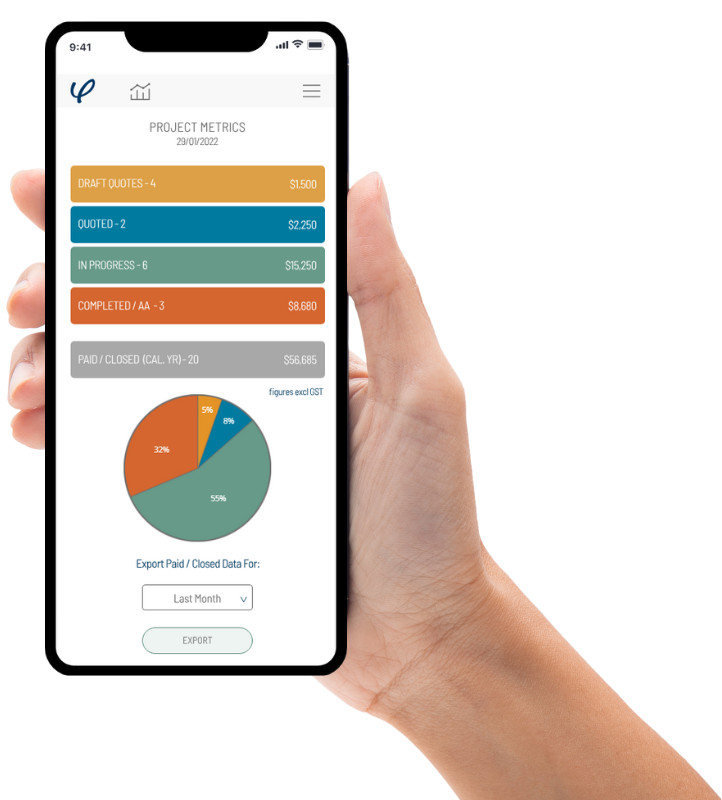

Reduce your payment admin by up to 80%

We’ve thought of everything you might need to include in a quote for services. It only takes a few minutes to create and send a quote to your customer. Once it’s accepted, your payment admin is automated – including invoice receipts sent and your instant payment once the job is complete.

Eliminate late payments & debtors

Your customer simply accepts the quote and goes straight to payment transfer. Payment details are pre-populated so your customer has a smooth payment process. It couldn’t be easier and more secure. Before the job starts, you know that your customer has the funds for the job, and your customer knows that you will be paid instantly, when both parties agree the job is complete.

How the Customer accepts a quote and pays

Packed with Features

Payment protection isn’t the only reason to love IPromise, our automated quoting, invoicing, instant payment, project management and chat functions are just a few of the reasons why our users love IPromise.

Secure

Payments

Get Paid

Immediately

Reduced

Admin

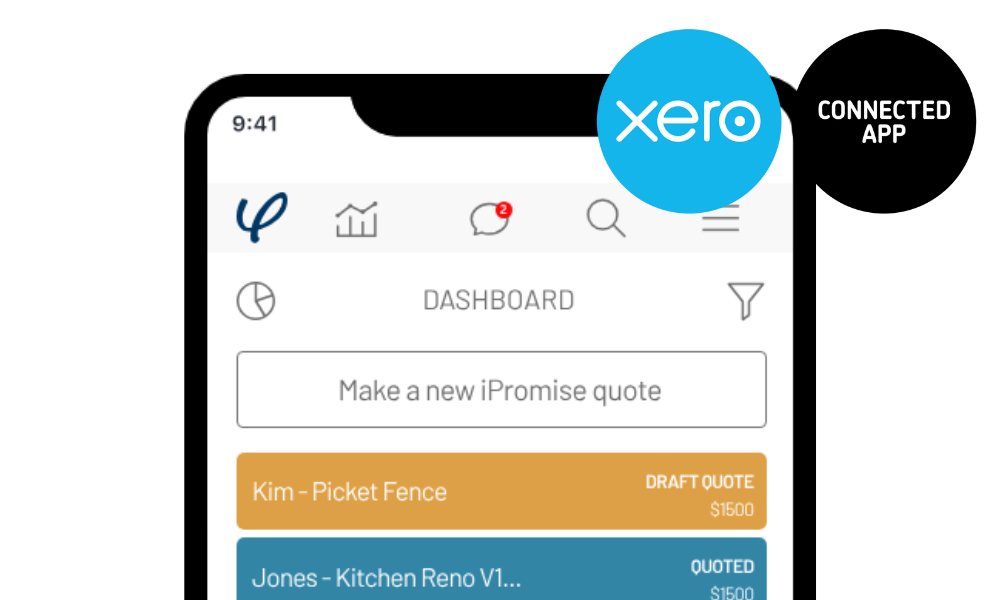

Xero

Integration

Hear from others – don’t take our word for it!

As a service provider, we decided we wanted to start de-risking our cash flow – and IPromise was the answer. The biggest three benefits we’ve gotten so far are; 1. IPromise secures payment for our services before we have even started the work (we can see the funds are sitting in a trust ready for payout once we’ve finished work), 2. IPromise increases our cash flow (we get those funds as soon as a project is completed, not when the invoice is due 20 days later), and 3. It provides us with a new USP against our competitors (deposits and upfront payments sit in a trust, we don’t get paid unless we complete work so we can’t run away with your deposits). The whole solution is a no-brainer for anyone running a services business.

IPromise provides security for both parties. They were really supportive during the sign up process in producing a hardcopy of the process that we can attach to our contract – real people to talk to!

‘It has been such an easy process to use that we will definitely be recommending this to our clients in the future’

When a builder sent me a quote through IPromise, I wasn’t sure what it was. However, after the easy and professional onboarding process there was no looking back. I love the instant chat and I feel IPromise has improved the security of my payments and added professionalism and transparency to projects.

IPromise is such a great product and addresses all that is wrong with the current invoicing and payment process. It’s fair and secure and removes the need for those unsecured deposits to suppliers.

Packed With Features

Quoting Tools

Payment Options

Xero Integration

Instant Chat

FAQs

Yes, and it’s affordable and easy. Visit this page for more information. We can also help you make sure you are meeting the Construction Contracts (Retention Money) Amendment Act 2023 thanks to our partner Ford Sumner Lawyers / Tradie Law.

Yes, you can pay for quotes from Suppliers/Sellers who are using IPromise with your NZ Credit or Debit Card, up to a limit of $10,000.

We now offer a Xero payment integration. Businesses can now connect their business Xero account to their IPromise account in seconds.

That means every time a quote is accepted by your customer and payment is released to you for a job completed, quotes and invoices are automatically mirrored to your Xero account.

Even better, that invoice is PAID – no debtors ledger, no outstanding invoices, no email or phone call payment reminders – only immediate payment on successful project completion with IPromise. Fair, secure and saving you valuable payment administration time.

See our explainer video here.

All our Customers have the opportunity to benefit from the full functionality of IPromise for 90 days. We have selected 90 days because most services (that our Customers provide) take weeks to quote, secure payment and then deliver. IPromise is committed to providing users with the opportunity to experience as many of the key features and benefits as possible.

After the 90 days, in order for Customers to receive payments from their customers (via our secure BNZ Trust account or escrow account), they will need to select from one of the three monthly subscription options. See our pricing page for more details.

However, all ‘Quoted’, ‘In Progress’ and ‘Completed Awaiting Approval’ projects within the 90-day trial period will continue to remain active and free until completion.

IPromise is ALWAYS free for your customers.

The best way to cover investigations of faults (or unknown outcomes) is to quote and send your customer the minimum cost of the call out fee. For example, it might be one hour of your time and travel (if applicable). Don’t go to the job until your customer has paid the minimum amount into the secure BNZ Trust Account (escrow account). You can then attend the job, complete the investigation and add a variation to that ‘call out fee quote’ detailing the work you have found that is required to be actioned.

That way you have at least locked away the call out fee money for your valuable time and your customer is clear about what additional costs are required. They can then decide to proceed or otherwise with the remediation. The great thing about IPromise is that by completing the first ‘call out fee quote’ you have all the correct contact details for your customer saved in IPromise and future quotes are transparent and simple to manage from then on.

Watch the explainer video.

Ratings for Users happen at the end of the transaction. It’s important to be constructive and fair. After a user receive 5 ratings the average will be displayed for other users to see. It’s good to keep this in mind throughout the project.

You can leave feedback for IPromise any time here. The IPromise team review feedback daily and your feedback helps to make what we do even better.

Please see our pricing information here.

Watch the explainer video.

From time to time Suppliers might require a deposit, for example, to purchase materials. This is less likely than in traditional transactions because IPromise securely and transparently holds your customer payments so you (the Supplier) knows the money is physically there for immediate release once your customer is satisfied the job, or a ‘Stage’ of the job, is done.

Your customers cannot take the money back unless you formally agree to it. If there isn’t agreement, IPromise outlines some recommended steps to work through. See here for more detail.

NZ law requires companies like IPromise to comply with Anti-Money Laundering and Countering Financing of Terrorism Act 2009. We take this responsibility and your security seriously so we use the very best identification and verification process to protect you and us from any illegal conduct.

We have partnered with Cloudcheck, an industry leading identification and verification company who automate and integrate the process for us using real time technology. This also helps to ensure we collect accurate information.

You can be sure we identify and verify all our Customers so IPromise knows that its Customers are not pretending to be someone they are not.

You may have noticed other sectors like lawyers, real estate agents and accountants requiring such checks.

Watch the explainer video.

The process is exactly the same as staging projects. Once a project is ‘In-Progress’ and a variation is required, it is important to identify this early with your customer and communicate (ideally through the secure IPromise chat) to explain the reasons for the variation and that you are going to require a formal variation.

You then go into the project summary and click on ‘Add Stage / Variation’, and simply explain in the variation quote what the specific variation is and the amount. Send this to your customer – we recommend you do not start the work on the variation until your customer has secured the variation quote by paying the specified amount into the secure BNZ Trust Account (escrow account).

Your customer’s protection, once again, is that you don’t get the money until the approved project (in this case, a variation to a project) is completed to your customer’s satisfaction.