The Risks of Buying and Selling on online Platforms

In today’s digital age, the convenience of online marketplaces like Facebook Marketplace and Trade Me has revolutionised the way we buy and sell goods. With just a few clicks, you can find a plethora of products ranging from electronics to clothing, all within arm’s reach. However, amidst this convenience lies a lurking threat: the risk of scams and non-delivery of the goods you wanted to buy. In this blog, we’ll delve into the key risks associated with online buy/sell platforms and why utilising services like Escrow and companies such as IPromise may be the only safe solution for online trades.

- Scams Galore: One of the most significant risks of buying and selling on online platforms is the prevalence of scams. Scammers can create fake profiles or listings to lure unsuspecting buyers or sellers into fraudulent transactions. These scams can range from non-existent items being advertised to counterfeit products being sold as authentic. Once the payment is made, the scammer disappears, leaving the victim with nothing but a sense of betrayal and financial loss

- Non-Delivery of Goods: Another common risk users face on online marketplaces is the non-delivery of goods. Even in legitimate transactions, there’s always a chance that the seller fails to deliver the promised item after receiving payment. This could happen due to various reasons such as logistical issues, miscommunication, or even dishonest intentions. Regardless of the cause, the buyer is left empty-handed and often struggles to recoup their money.

- Lack of Accountability: Unlike traditional retail transactions where there’s a physical store or entity to hold accountable, online transactions can lack accountability. Sellers might vanish into thin air after receiving payment, and buyers may have little to no recourse to reclaim their funds or pursue costly legal action.

- Unnecessary Anxiety – from the unknowns of online trading: There is unnecessary anxiety and stress from the many unknowns of online transactions like;

- Are they a real person?

- Will they even make the trade?

- Shall I pay a deposit?

- Are the goods legitimate?

- Shall I remove the listing as they said they will buy it?

- Shall I send the goods without getting the money, shall I pay without having received the goods? Who moves first? (‘Transaction Chicken’)

Escrow – A Safe Haven for Online Transactions:

In the face of these risks, utilising an escrow service emerges as a beacon of hope for both buyers and sellers in online transactions. Escrow works by holding the payment securely in a third-party (independent) account until the buyer receives the goods and verifies that they meet the agreed-upon condition. Only then is the payment released to the seller, providing a layer of protection against scams and non-delivery of goods.

It is also much needed protection for the seller. They know they can safely send the goods knowing that the buyer has the money and that money is secured in a third party (independent) account before the goods are sent.

Many companies already use Escrow and you probably have even paid in advance for things like concert tickets, travel through a travel agent or accommodation through platforms like Airbnb who hold onto your money and pass it on once the service has been provided.

IPromise – Your Trusted Partner in Online Transactions:

Companies like IPromise go a step further in ensuring the safety and security of online trades. With IPromise, buyers and sellers can rest assured that their transactions are protected until both parties are satisfied the agreed conditions of the trade have been met. It’s super easy to use either from your mobile phone or desktop computer.

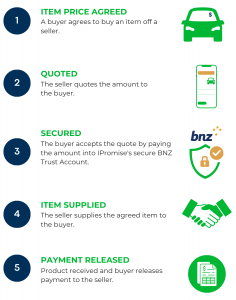

The 5 Step IPromise Process

Even better, in the unlikely event of a dispute, the money is kept safe until both parties agree to a resolution. This is excellent motivation for open and honest collaboration.

Prioritize Safety in Your Online Transactions:

While the convenience of online marketplaces like Facebook Marketplace and Trade Me is undeniable, it’s crucial to recognize and mitigate the inherent risks they may pose. Scams and non-delivery of goods can have devastating consequences for unsuspecting users. By leveraging escrow services like IPromise, you can mitigate these risks and ensure a safe and secure trading experience online. So, before you click that “buy” or “sell” button, remember to prioritize safety and consider using trusted third-party services for added protection.

Sign up today, it takes less than 3 minutes to open an IPromise account.

How Safe is IPromise?

IPromise has partnered with BNZ bank who holds the Trust Account (escrow account) on behalf of IPromise. Such an institution would only do so if they were satisfied in the controls, processes and credibility of IPromise. IPromise can only act on instruction from both parties.

IPromise also uses the industry standard and highly regarded Windcave to securely process all the payments within the IPromise system.

Cyber security is paramount and the gold standard of Microsoft security is used and holds an ‘A’ rating from the International cybersecurity company Black Kite.

For your added peace of mind, IPromise Limited (NZBN 9429049452358) operates within the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT) regulated by the DIA and is registered on the Financial Services Provider Register (FSP 1002306). IPromise is a member of the Financial Services Complaints Limited Dispute Resolution Scheme (DRS 8793).

Leave A Comment